Demystifying Margin Requirements in Futures Trading

작성자 정보

- 해선ATM 작성

- 작성일

컨텐츠 정보

- 912 조회

본문

Margin requirements play a crucial role in futures trading, but newcomers to the market may find them confusing. Without a clear understanding of margin requirements, managing risk and seizing opportunities are difficult. Our article aims to demystify margin requirements by providing a concise explanation of what they are, how they work, and why they matter in the world of futures trading. Whether you're a beginner or a seasoned trader, you'll gain valuable insights from our comprehensive guide.

What is Margin in Futures Trading?

Margin is the deposit that brokers require from traders to initiate a futures position. It serves as security to guarantee that traders fulfill their monetary responsibilities in case of unfavorable market changes. Margin specifications are defined by exchanges and clearinghouses and are influenced by underlying assets, volatility, and other aspects.

Initial Margin vs. Maintenance Margin

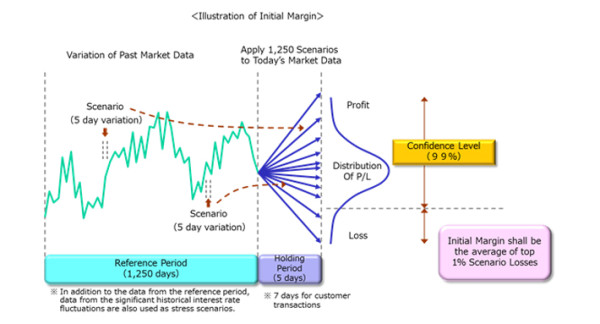

There are two types of margin requirements: initial margin and maintenance margin. The initial margin is the minimum amount of funds required to open a futures position, usually a percentage of the contract's total value. Maintenance margin, on the other hand, is the minimum amount of funds that traders must maintain in their accounts to keep their positions open. If the account's balance falls below the maintenance margin level, traders may receive a margin call and need to add funds to meet the requirement.

Leverage and Margin

One of the key benefits of futures trading is leverage, which allows traders to control a larger position with a smaller initial investment. Leverage magnifies both profits and losses. While leverage can enhance potential gains, it also increases the risk of losses. Margin requirements play a crucial role in regulating leverage, ensuring that traders have sufficient funds to cover potential losses and protect against excessive risk.

Calculation and Variation of Margin Requirements

Gain insight into the cost of trading with our margin requirements calculator. We calculate margin requirements using the notional value of a contract, price fluctuations, and the margin rate set by the exchange. With varying margin rates for different contracts, you can rest assured our calculator considers each one to reflect the volatility and current market conditions. It's important to note that margin requirements are dynamic, and any shifts in market conditions can result in imposed margin calls by exchanges. Stay ahead of market volatility with our margin requirements calculator.

Risk Management and Margin Requirements

Effective risk management in futures trading requires a thorough understanding and management of margin requirements. Traders must evaluate their risk tolerance, establish proper stop-loss orders and keep a close eye on their account balance to ensure it remains above the maintenance margin level. Employing smart risk management strategies and maintaining adequate margin levels will safeguard against potential losses and facilitate sustainable trading behavior.

Margin Requirements and Margin Calls

Margin calls happen when a trader's account balance drops below the maintenance margin level. In such cases, traders are usually expected to inject more funds into their accounts to meet the margin requirement. If traders fail to meet a margin call, the broker may sell off their position to get back lost funds. Traders should be mindful of margin calls and have a solid strategy to handle their positions and meet margin requirements efficiently.

Education and Resources

Brokers and exchanges offer resources and tools to broaden traders' understanding of margin requirements and their implications. It is crucial for traders to equip themselves with knowledge about leverage, margin requirements, and risk management strategies. This knowledge enables traders to make informed decisions, reduce risks and enhance trading performance.

Margin requirements play a crucial role in futures trading, enabling risk management and market integrity. Familiarity with these requirements allows traders to approach futures with confidence, adopt effective risk management techniques, and take advantage of the opportunities presented by this dynamic and exciting market.

해외선물이란 바로가기

선물대여계좌란 바로가기

선물기초교육 바로가기

선물차트교육 바로가기

선물관련뉴스 바로가기

선물관련분석 바로가기

경제캘린더 바로가기

공지사항 바로가기

회원이벤트 바로가기

출석&가입인사 바로가기

자유게시판 바로가기

회원수익인증 바로가기

보증업체 보러가기

먹튀업체 보러가기

제보&문의 바로가기

안전업체신청 바로가기